Why Only Equity?

Investing in the stocks and shares of companies is one of the ways to achieve long-term growth within an investment portfolio, as the value of the shares may increase over time. Shares in some companies also offer the potential to receive income in the form of dividend payments.

The returns from equities depend on a number of factors, such as economic conditions, market sentiment and company news. Over the long term, equity markets have endured fluctuating conditions to outperform real estate, bonds and cash deposits.

Investing in equities does carry a higher level of risk than investing in other asset classes, however, and you should therefore expect greater volatility. Despite this, when used as part of a well-diversified portfolio, equities have historically proven an effective method of growing capital over the long term and protecting against inflation.

Comparison with Other Assets Classes

For comparison we take Sensex (for equities), which begins in 1979 at a 100 points. Today, it stands in the vicinity of 28,000 or a growth of 280 times in 36 years. Over the same period, gold has risen 38 times. So INR 10,000 invested in the Sensex in 1979 would be INR 28 lakh today while the same amount invested in gold would be INR 3.8 lakh.

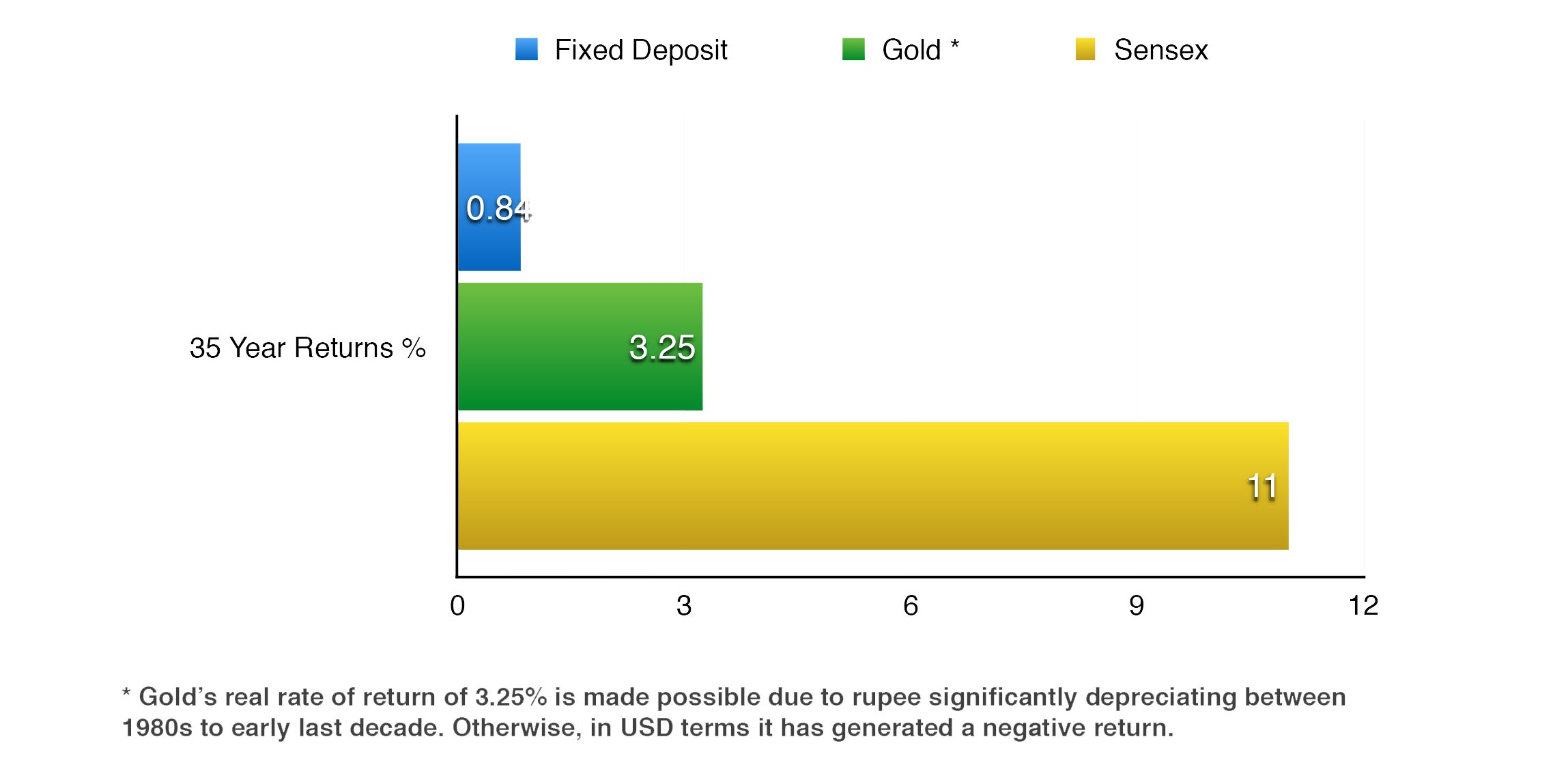

Absolute Returns (%) Across Asset Classes

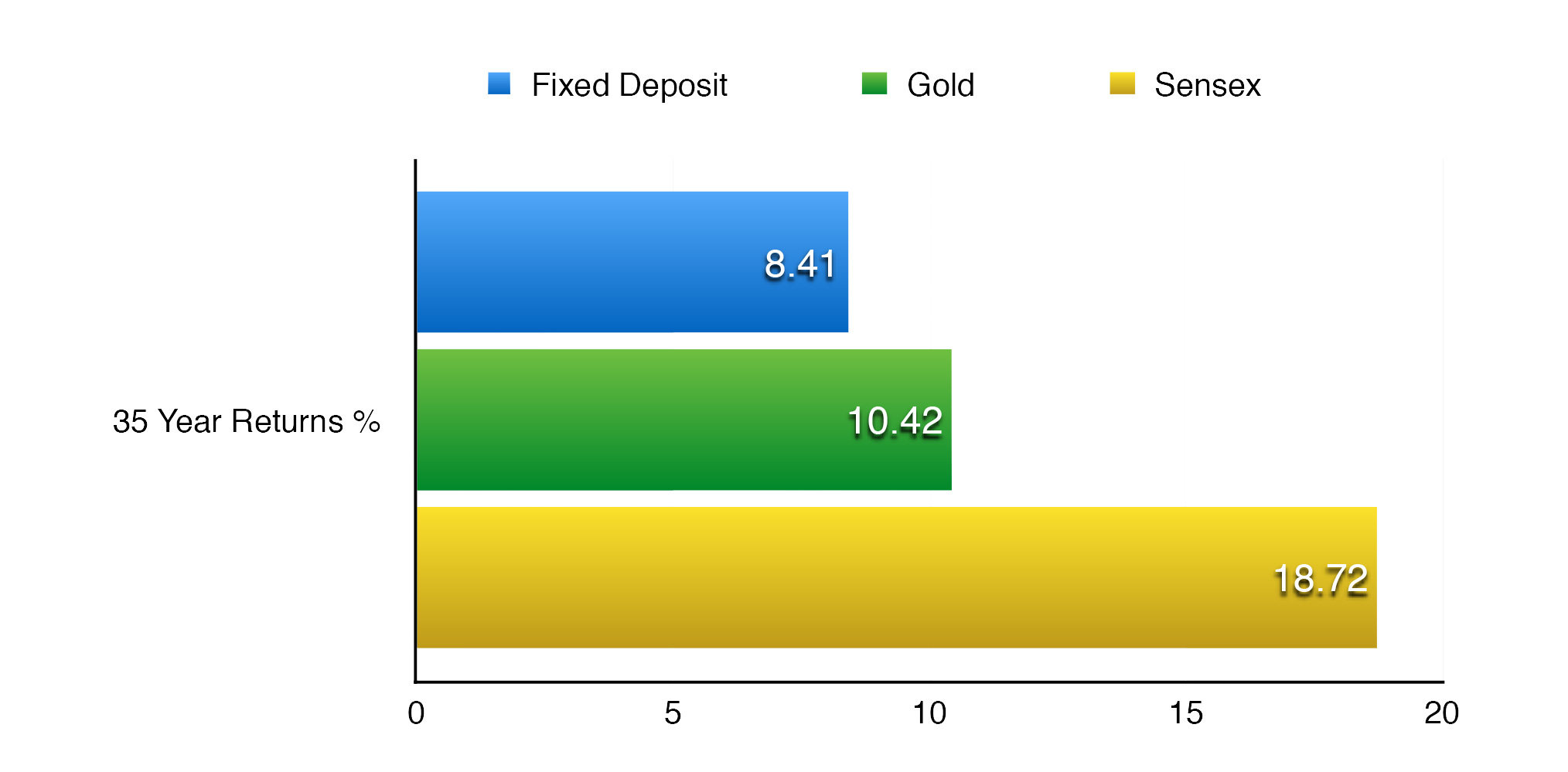

Inflation Adjusted Returns (%) Across Asset Classes